Tap into My Equity(https://tapintomyequity.ca/) is a company that I would highly recommend freelancers avoid at all costs. My experience with this company has been incredibly negative, and I feel compelled to share my story to warn others. I completed a project for Tap into My Equity, and despite several attempts to contact the company for payment, I have yet to receive any compensation for my services. The lack of professionalism and disregard for timely payment has left me feeling undervalued and disrespected as a freelancer.

The desire of homeownership usually comes bundled with the thought of constructing fairness. It truly is that perception of accumulating wealth in just your individual walls, a rising nest egg represented from the mounting value of your house. But Imagine if you can unlock that probable, turn that equity into usable money? Which is where the idea of tapping into your own home fairness is available in.

You will find a multitude of explanations why a homeowner could consider this option. Perhaps an unpredicted expenditure has reared its head, a medical bill or perhaps a vital property repair service that throws a wrench into your economical designs. Perhaps you have been eyeing a desire renovation, a person that could add significant value to your private home while improving your Standard of living. Or possibly credit card debt consolidation would be the aim, streamlining a number of large-interest debts into a single, extra workable mortgage.

Regardless of the motive, comprehension the best way to tap into your own home equity is crucial. The excellent news is, you'll find established economical equipment at your disposal, Every with its have rewards and concerns. Let us delve into the most common possibilities:

**The Home Equity Personal loan:** Usually generally known as a 2nd property finance loan, a home equity personal loan permits you to borrow a hard and fast sum of cash depending on the appraised price of your home and the quantity of fairness you've got built up. This equity is usually the distinction between your home's existing current market benefit and what you still owe in your current home finance loan. Once authorized, you receive a lump sum payment that you just then repay around a established time period, generally among five and thirty a long time, with a set curiosity fee.

This feature can be quite a fantastic in good shape for people who have to have a transparent, described sum of money upfront for a particular goal. The mounted curiosity price provides predictability inside your month-to-month payments, and because it is a individual mortgage from your mortgage, it would not effects your current mortgage loan terms (assuming you secured a positive fee at first). However, it is vital to bear in mind you are introducing A different financial debt obligation in addition to your existing mortgage, so watchful budgeting is crucial.

**The house Equity Line of Credit rating (HELOC):** This option features more just like a charge card secured by your house fairness. As soon as permitted, you're presented a credit limit you can access on an as-essential foundation. Envision a revolving line of credit rating, in which you only spend curiosity on the quantity you borrow. This adaptability may be eye-catching, specifically for ongoing projects or surprising charges.

There's usually a draw time period that has a HELOC, a established timeframe in which you can obtain the resources freely, with minimum payments usually focused on curiosity only. After that draw period ends, you enter a repayment period exactly where your minimal payments Tap into My Equity will boost to include principal along with the interest. The variable interest rate on a HELOC can be a double-edged sword. Whilst it might be lessen than a hard and fast-amount financial loan to begin with, it could possibly fluctuate after some time, most likely impacting your regular payments.

**The Funds-Out Refinance:** This option entails refinancing your present home finance loan for a better sum than what you currently owe. You pocket the primary difference as funds, primarily utilizing your created-up equity. To illustrate your property's benefit has enhanced substantially, and you have paid down a considerable portion of your first home loan. A hard cash-out refinance lets you faucet into that improved benefit and use the cash for various needs.

The benefit of a money-out refinance is you can possibly safe a lessen interest fee than your present mortgage, particularly if fascination fees have dropped since you very first ordered your home. This can result in important price savings more than the long term. Nonetheless, it is important to bear in mind you might be extending the repayment time period on the mortgage, possibly adding a long time in your bank loan. Moreover, some lenders have constraints on the amount of funds you will take out by way of a income-out refinance.

Tapping into your house equity is usually a robust financial Instrument, but it isn't a decision to generally be taken flippantly. In advance of embarking on this path, cautiously consider your explanations for needing the cash. Is it a necessary expenditure, a strategic investment decision, or a temporary Alternative? Keep in mind, you happen to be Placing your house at stake, so accountable use of the borrowed cash is paramount.

Consulting having a economical advisor could be a must have. They can assist you evaluate your economic situation, examine different possibilities available, and information you towards the best suited tactic for tapping into your house equity. Try to remember, a effectively-educated decision can unlock the likely in just your walls and empower you to attain your money goals.

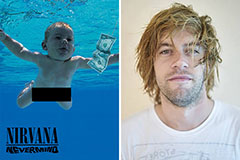

Spencer Elden Then & Now!

Spencer Elden Then & Now! Ariana Richards Then & Now!

Ariana Richards Then & Now! Ashley Johnson Then & Now!

Ashley Johnson Then & Now! Seth Green Then & Now!

Seth Green Then & Now! Raquel Welch Then & Now!

Raquel Welch Then & Now!